Services

- The support extended by the facility helps accelerate the development of DRE businesses and projects.

- The project developer or financial intermediary gets to access a wide array of empanelled service providers for various project preparation services.

- The facility enables access to a wide range of capital from debt to equity, and from project term loans to working capital finance.

- The project developer or financial intermediaries becomes investment-ready for appropriate type of financing.

What kind of businesses or projects will be supported?

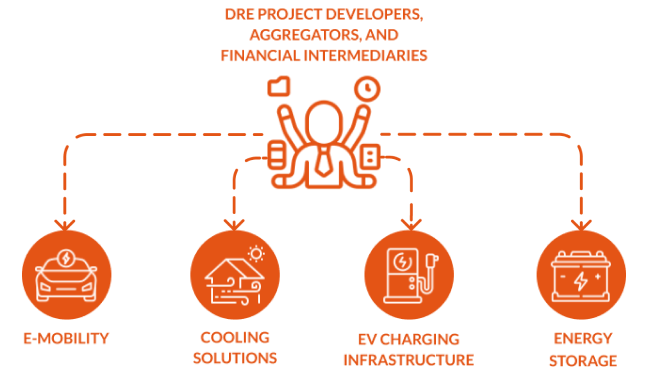

ICEF aims to accelerate progress towards India’s renewable energy and energy access goals, by supporting early-stage development of distributed renewable energy (DRE) projects and helping to catalyze long-term financing. ICEF invites DRE project developers, aggregators, and financial intermediaries who operate in the following categories in India to apply for support:

Eligibility criteria

- The proposed business or project must be focused on developing DRE applications for external commercial consumption.

- Projects must utilize technologies that have already been proven in commercial operations and/or tested at a Ministry of New and Renewable Energy (MNRE) accredited lab.

- The Project Developer should not be blacklisted by any government or public sector agency in India.